Explore web search results related to this domain and discover relevant information.

The report highlights that as of July 2025, loans to MSMEs and unsecured personal loans accounted for 17 per cent of banks' non-food credit, which stood at Rs 184 trillion. For NBFCs, loans to small businesses and unsecured consumption loans comprised nearly 34 per cent of their total credit ...

The report highlights that as of July 2025, loans to MSMEs and unsecured personal loans accounted for 17 per cent of banks' non-food credit, which stood at Rs 184 trillion. For NBFCs, loans to small businesses and unsecured consumption loans comprised nearly 34 per cent of their total credit of Rs 35 trillion as of March 2025.New Delhi, [India] September 10 (ANI): Indian banks incremental credit to grow by Rs 19 trillion to 20.5 trillion, translating into a year-on-year growth of 10.4-11.3 per cent according to a report by rating agency ICRA.However, supported by improved economic activity and recent policy measures, non-banking financial companies (NBFCs), excluding infrastructure-focused entities, are estimated to register a 15 to 17 per cent expansion in the current fiscal. According to ICRA, the momentum comes despite a slower start in the first five months of FY26, where incremental bank credit stood at Rs 3.9 trillion against Rs 5.1 trillion in the same period last year.The agency believes the recent GST rate cuts, coupled with an upcoming reduction in the cash reserve ratio (CRR), will stimulate domestic demand and support credit expansion across both banks and NBFCs. "Asset quality stress in retail and MSME segments resulted in a slower growth for private sector banks as well as NBFCs.

Read Cash or Credit [Official] - Chapter 34 | KaliScan. The next chapter, Chapter 35 is also available here. Come and enjoy! Keith, a legendary con artist who made a career out of swindling mafias and criminal syndicates, finds himself cornered by the police.

Read Cash or Credit [Official] - Chapter 34 with HD image quality and high loading speed at KaliScan. And much more top manga are available here. You can use the Bookmark button to get notifications about the latest chapters next time when you come visit KaliScan.Page Navigation: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55

34 of 2005 · The National Credit Act 34 of 2005 intends: to promote a fair and non-discriminatory marketplace for access to consumer credit and for that purpose to provide for the general regulation of consumer credit and improved standards of consumer information; to promote black economic ...

34 of 2005 · The National Credit Act 34 of 2005 intends: to promote a fair and non-discriminatory marketplace for access to consumer credit and for that purpose to provide for the general regulation of consumer credit and improved standards of consumer information; to promote black economic empowerment and ownership within the consumer credit industry; to prohibit certain unfair credit and credit-marketing practices; to promote responsible credit granting and use and for that purpose to prohibit reckless credit granting; to provide for debt re-organisation in cases of over-indebtedness; to reAmended by National Credit Amendment Act 7 of 2019Amended by National Credit Amendment Act 19 of 2014

Loans to MSMEs and unsecured personal loans accounted for 17 per cent of the overall non-food credit of ₹184 lakh crore for the banks as of July 2025. Loans to small businesses, and unsecured personal and consumption loans, stand at approximately 34 per cent of the total NBFC credit of ₹35 ...

Loans to MSMEs and unsecured personal loans accounted for 17 per cent of the overall non-food credit of ₹184 lakh crore for the banks as of July 2025. Loans to small businesses, and unsecured personal and consumption loans, stand at approximately 34 per cent of the total NBFC credit of ₹35 lakh crore as of March 2025.GST rate cuts to boost credit growth for banks and NBFCs, despite rising credit costs, according to ICRA.The agency estimated the incremental credit flow of banks to rise to ₹19.0-20.5 lakh crore in FY2026 from ₹18.0 lakh crore in FY2025, translating into a year-on-year (y-o-y) credit growth of 10.4-11.3 per cent for banks in the current fiscal compared to 10.9 per cent in FY2025 and 16.3 per cent in FY2024.Referring to the pace of incremental bank credit growth in the current year lagging at ₹3.9 lakh crore for 5M (five months) FY2026 compared to ₹5.1 lakh crore for the previous year, ICRA opined that the recent GST rate cuts aimed at spurring domestic demand and to partly offset the tariff impact on the exports would support credit expansion for banks and NBFCs in the near term.

You need 30 credits to meet Ontario Secondary School Diploma graduation requirements. Most students will complete these credits within four years. If needed, you may earn up to 34 credits within five years.

Speak with your guidance counsellor who can help you to map out a course plan that is flexible, that can be revised and that will support you in being prepared for post-secondary without having to exceed 34 credits in 4 years.You need 30 credits to meet Ontario Secondary School Diploma graduation requirements. Most students will complete these credits within four years. If needed, you may earn up to 34 credits within five years.While enrolled in your first four consecutive years of secondary school, you may go beyond 34 credits.Yes. For students successfully completing a credit course more than once, each successful completion counts toward the 34 credit threshold, however, only one of these credits counts towards the OSSD.

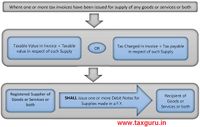

Unlock the conditions for charging GST on credit notes as per Section 34 of the CGST Act. Understand the eligibility criteria and time limits for issuing credit notes in the GST framework.

Understand the eligibility criteria and time limits for issuing credit notes in the GST framework. ... Section 34 of the CGST Act plays a crucial role in regulating credit and debit notes in the context of goods and services. This article aims to provide a comprehensive understanding of this section and its implications.We will analyze the provisions of Section 34(1) and (2), delve into the reasons for issuing credit notes, explore the time limits for issuing such notes, and examine the conditions that must be fulfilled for eligibility.By exploring these aspects, we will gain insights into the conditional nature of GST credit notes and their significance in the GST framework. Join us as we navigate through the intricacies of Section 34 and shed light on the important considerations surrounding credit notes under the CGST Act.The reasons for raising a GST credit note are clearly stated for points 2) and 3) above. However, point 1) is open to cover scenarios such as rate revision or discounts given, among others. ... Section 34(2) provides the time limit for the supplier to issue a credit note with GST.

Answer (1 of 2): Credit hours represent the number of full-time and part-time classes taken, as part of a total degree. The method of measurement varies with the university - and the country - so look on the website of the institution to find out. For instance, at the University of Toronto, a ful...

Experian is committed to helping you protect, understand, and improve your credit. Start with your free Experian credit report and FICO® score.

Approval of your application will result in a hard inquiry, even if you’re unable to pass final verifications, which may impact your credit scores.Introducing the digital checking account designed by credit experts. You could raise your credit scores just for paying bills like rent, internet and utilitiesø.As your BFF, we’ll help you manage your money on the go, send real-time credit alerts straight to your phone, and a lot more.Manage your credit basics with these free tools.

Loans to MSMEs and unsecured personal loans accounted for 17 per cent of the overall non-food credit of Rs.184 lakh crore for banks as of July 2025. Loans to small businesses, and unsecured personal and consumption loans, stand at approximately 34 per cent of the total NBFC credit of Rs.35 ...

Loans to MSMEs and unsecured personal loans accounted for 17 per cent of the overall non-food credit of Rs.184 lakh crore for banks as of July 2025. Loans to small businesses, and unsecured personal and consumption loans, stand at approximately 34 per cent of the total NBFC credit of Rs.35 lakh crore as of March 2025.New Delhi, Sep 10 : The incremental credit flow of banks is expected to rise to Rs.19-20.5 lakh crore in FY2026 from Rs.18 lakh crore in FY2025 which represents a year-on-year (YoY) growth of 10.4-11.3 per cent for banks in the current financial year compared to 10.9 per cent in FY2025, according to an ICRA report released on Wednesday.While the pace of incremental bank credit growth in the current year lags at Rs.3.9 lakh crore for the first five months of FY2026 compared to Rs.5.1 lakh crore for the previous year, the GST rate cuts aimed at spurring domestic demand would support credit expansion for banks and NBFCs in the near term.ICRA senior vice president Anil Gupta said, "Asset quality stress in retail and MSME segments resulted in slower growth for private sector banks as well as NBFCs. With improvement in economic activity post GST rate cuts, the growth appetite shall improve, which will support the credit growth."

Wondering how all those credit hours add up? AIC abides by the standard Carnegie Unit to calculate credit hours for all traditional and distance courses.

AIC uses the industry-standard Carnegie Unit to define credit hours for both traditional and distance courses.Each credit hour corresponds to a minimum of 3 hours of student engagement per week for a traditional 14-week course or 6 hours per week for a 7-week course.Most courses at AIC are three credit hours.American International College

HUD-approved housing counseling ... or creditor are not loan originators if the compensation is not contingent on referrals or on engaging in additional loan origination activities and either of two alternative conditions is satisfied: The first alternative condition is that the compensation is expressly permitted by applicable local, State, or Federal law that requires counseling and the counseling performed complies with such law (for example, § 1026.34(a)(5) and ...

HUD-approved housing counseling agencies who simply assist a consumer in obtaining or applying to obtain consumer credit from a loan originator or creditor are not loan originators if the compensation is not contingent on referrals or on engaging in additional loan origination activities and either of two alternative conditions is satisfied: The first alternative condition is that the compensation is expressly permitted by applicable local, State, or Federal law that requires counseling and the counseling performed complies with such law (for example, § 1026.34(a)(5) and § 1026.36(k)).§ 1026.36 is part of 12 CFR Part 1026 (Regulation Z). Regulation Z protects people when they use consumer credit.Referring includes any oral or written action directed to a consumer that can affirmatively influence the consumer to select a particular loan originator or creditor to obtain an extension of credit when the consumer will pay for such credit.A person who, acting on behalf of a loan originator or creditor, collects information or verifies information provided by the consumer, such as by asking the consumer for documentation to support the information the consumer provided or for the consumer's authorization to obtain supporting documents from third parties, is not collecting information on behalf of the consumer.

Section 129 of the National Credit Act 34 of 2005 When you are 20 business days or more in default with your payments in terms of a credit agreement, you will be advised of your default by way of a Notice in terms of Section 129 (hereinafter “the notice”) of the National Credit Act ...

Section 129 of the National Credit Act 34 of 2005 When you are 20 business days or more in default with your payments in terms of a credit agreement, you will be advised of your default by way of a Notice in terms of Section 129 (hereinafter “the notice”) of the National Credit Act (hereinafter…Section 129 of the National Credit Act 34 of 2005 When you are 20 business days or more in default with your payments in terms of a credit agreement, you will be advised of your default by way of a Notice in terms of Section 129 (hereinafter “the notice”) of the National Credit Act (hereinafter “the NCA”)You will be advised that you may refer the credit agreement to a debt counsellor, an alternative dispute resolution agent, consumer court or ombud with jurisdiction in order to help resolve any dispute you might have under this agreement, or to develop and agree on a plan to bring the payments under this agreement up to date.Section 81(2) of the Act states that, before entering into a credit agreement the credit provider will attend to a financial assessment and will grant credit to you based on the outcome of the aforesaid financial assessment.

Learn about GST credit notes under Section 34, including issuance conditions, time limits, reporting in returns, and impact on supplier and recipient liabilities.

Section 34 of the GST Act outlines the provisions related to credit notes, an essential tool for adjusting invoice values under specific circumstances. A credit note is issued by a registered supplier to reduce the taxable value or correct discrepancies in the original invoice.the conclusions drawn are not fully correct… There is time limit to issue credit note… the Credit note due date is 30 September of next financial year and not 30 November ... Please read Section 34 of GST Act.Common scenarios for issuing a credit note include errors in the taxable value, charging higher tax rates than applicable, or situations where goods or services are returned by the recipient due to defects or rejection.There is no legal restriction on the time of issuing a credit note; however, it must be reported in GST returns within a specified period, typically by November 30 of the following financial year or the filing date of the annual return (GSTR-9), whichever comes earlier.

I have just discovered a charge for $34.48 on my Visa credit account. It is listed as CRDREGISTRYToronto. I do not know

Customer: Hello, I have just discovered a charge for $34.48 on my Visa credit account. It is listed as CRDREGISTRY###-##-####Toronto. Technician's Assistant: Okay, I'll connect you to the Computer Expert who can help you. Does anyone else have access to this Visa credit account?When you see an unfamiliar charge like CRDREGISTRY on your credit card, first review recent purchases and subscriptions. Contact your bank or card issuer immediately to report the charge and request a transaction investigation. Check if any authorized users made purchases or if your card details were compromised.How to update credit card for.We just discovered a charge of $24.95 on my Dad's credit card for MalwareBytes coverage.

Debt relief involves various measures and strategies that are designed to alleviate and/or restructure debt obligations of the borrower so as to enhance their capacity to comply with such obligations when they are due. This article assesses the adequacy of Chapter 4 of the National Credit Act 34 of ...

Debt relief involves various measures and strategies that are designed to alleviate and/or restructure debt obligations of the borrower so as to enhance their capacity to comply with such obligations when they are due. This article assesses the adequacy of Chapter 4 of the National Credit Act 34 of 2005 (NCA) in relation to the recovery processes of businesses operated by natural persons, especially sole proprietorships.Lessons from Kenya. PER Journal, 22(1), pp. 1-34. Maghembe, N. (2011). The Appellate Division has Spoken - Sequestration Proceedings Do Not Qualify · as Proceedings to Enforce a Credit Agreement Under the National Credit Act 34 of 2005: Naidoo vChitimira, H., & Mpofu, K. (2023). Evaluating the Utilisation of the National Credit Act 34 of 2005 to Enhance the Recovery of Distressed Financial Entrepreneurs: Lessons from the United States of America. Acta Universitatis Danubius. Juridica, 19(3), 50–68.Credit Act 34 of 2005: A Tale of Two Judgments. Potchefstroom Electronic Law Journal, 13(3), pp.

Article explains about Credit Note and Debit Note under GST, Purpose of GST Credit/Debit Note, Conditions for issuing GST Credit/Debit Notes, Implications on issue of GST Credit/Debit Note, Time Limit for issuance of GST Credit/Debit Note and When to issue Financial Credit/Debit Note.

Once the credit note has been issued, the tax liability of the supplier will reduce. Section 34(1) provides that where one or more tax invoices have been issued for supply of any goods or services or both and the taxable value or tax charged in that/those tax invoice(s) is found to exceed the taxable value or tax payable in respect of such supply, or where the goods supplied are returned by the recipient, or where goods or services or both supplied are found to be deficient, the registered person, who has supplied such goods or services or both, may issue to the recipient one or more credit notes for supplies made in a financial year containing the prescribed particulars.credit notes for supplies wef 01st Jan , we will issue only commercial credit notes instead of taxable credit notes . As such there will not be any GST applicable on these credit notes . Pl refer to GST circular Issuance of Credit Note under Section 34 of the CGST Act and Section 15(3) of the Central Goods & Services Tax, 2017 (‘CGST Act’).Section 34(3) provides that where one or more tax invoices have been issued for supply of any goods or services or both and the taxable value or tax charged in that tax invoice is found to be less than the taxable value or tax payable in respect of such supply, the registered person, who has supplied such goods or services or both, shall issue to the recipient one or more debit notes for supplies made in a financial year containing the prescribed particulars.I. Purpose of GST Credit Note:-

Section 129 of the National Credit Act 34 of 2005 When you are 20 business days or more in default with your payments in terms of a credit agreement, you will be advised of your default by way of a Notice in terms of Section 129 (hereinafter “the notice”) of the National Credit Act ...

Section 129 of the National Credit Act 34 of 2005 When you are 20 business days or more in default with your payments in terms of a credit agreement, you will be advised of your default by way of a Notice in terms of Section 129 (hereinafter “the notice”) of the National Credit Act (hereinafter…Section 129 of the National Credit Act 34 of 2005 When you are 20 business days or more in default with your payments in terms of a credit agreement, you will be advised of your default by way of a Notice in terms of Section 129 (hereinafter “the notice”) of the National Credit Act (hereinafter “the NCA”)You will be advised that you may refer the credit agreement to a debt counsellor, an alternative dispute resolution agent, consumer court or ombud with jurisdiction in order to help resolve any dispute you might have under this agreement, or to develop and agree on a plan to bring the payments under this agreement up to date.Section 81(2) of the Act states that, before entering into a credit agreement the credit provider will attend to a financial assessment and will grant credit to you based on the outcome of the aforesaid financial assessment.

Justia Free Databases of U.S. Laws, Codes & Statutes

34:1B-319 Awarding of base tax credit. 51. a. Up to the limits established in subsection b.51. a. Up to the limits established in subsection b. of this section and in accordance with a tax credit agreement, beginning upon the receipt of occupancy permits for any portion of the community-anchored project, or upon any other event evidencing project completion as set forth in the tax credit agreement, an anchor institution and, if applicable, each partner institution of an approved community-anchored project shall be awarded a base tax credit of $5,000,000 for conversion into an authority investment in the community-anchored project.b. An anchor institution and, if applicable, each partner institution may be allowed a tax credit in excess of the base amount, if approved by the authority, provided, however, the total tax credit allowed per community-anchored project shall not exceed $75,000,000 and the total investment of all State resources not including rent payments in a community-anchored project shall not exceed 40 percent of the total cost of the project.

(13 March 2015 – to date) NATIONAL CREDIT ACT 34 OF 2005 (Gazette No. 28619, Notice No. 230 – See Act for Commencement dates) REGULATIONS MADE IN TERMS OF THE NATIONAL CREDIT ACT, 2005 (ACT NO. 34 of 2005) Published under Government Notice R489 in Government Gazette 28864, dated 31 May 2...

More in this category: « Regulations made in terms of the National Credit Act, 2005 (Act No. 34 of 2005) Debt Counselling Regulations 2012 »"the Act" means the National Credit Act, 2005 (Act No. 34 of 2005) as amended.(1) The register maintained by the National Credit Regulator as required in terms of section 53 of the Act must include the following information as set out in Form 34:(3) The National Credit Regulator must maintain a register of all registrants registered with a Provincial Regulator and must include the information as set out in Form 34.1.

Intuit Credit Karma offers free credit scores, reports and insights. Get the info you need to take control of your credit.

Personalized recommendations, tools and insights from Intuit Credit Karma that help you optimize your money and grow it faster, to help you get ahead.Join the 140+ million members making progress with Credit Karma.*Approval Odds are not a guarantee of approval. Credit Karma determines Approval Odds by comparing your credit profile to other Credit Karma members who were approved for the card shown, or whether you meet certain criteria determined by the lender. Of course, there's no such thing as a sure thing, but knowing your Approval Odds may help you narrow down your choices.